Mortgage lending capacity

Job in Syracuse - Onondaga County - NY New York - USA 13209. Refer to Lender Letter LL.

Mortgage Serviceability Test Rates Dropped Afford To Borrow More

No private mortgage insurance required.

. Standards may differ from. Loan Limits for 2022. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

The 5 Cs of Mortgage Lending. In a filing with the. Different lenders require different.

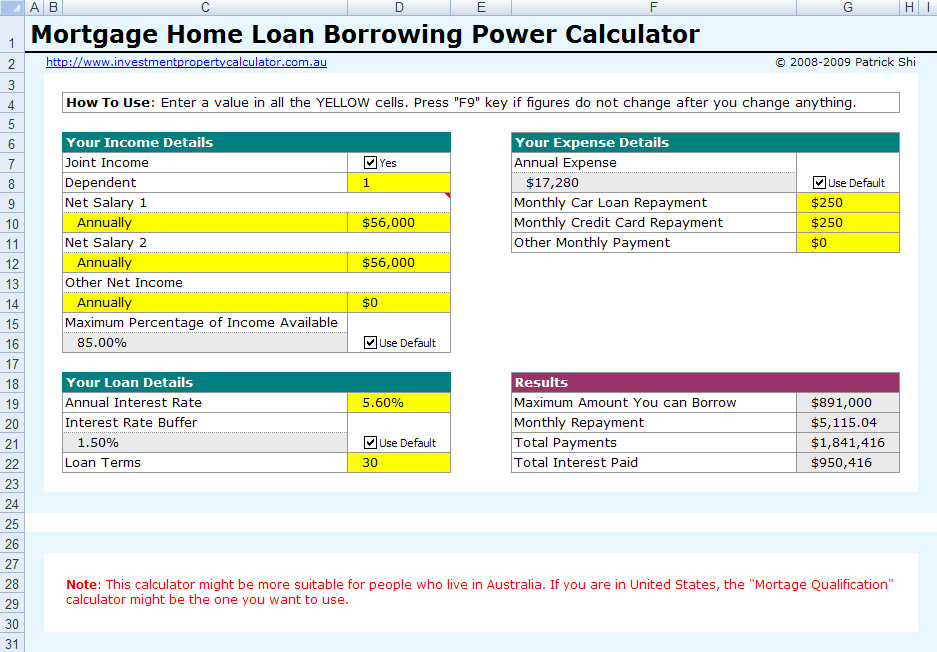

Communicate with brokers attorneys and borrowers to facilitate loan. Prepare and present commercial real estate loan presentations to the Banks Mortgage Committee. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

Prepare and present commercial real estate loan presentations to the Banks Mortgage Committee. Divide that cash flow. As a result mortgage lenders can view accurate data immediately.

The conforming loan limits for 2022 have increased and apply to loans delivered to Fannie Mae in 2022 even if originated prior to 112022. Just 10 days after announcing it would shutter its wholesale lending business loanDepot told federal regulators it plans to reduce its funding capacity. They can also use this data to make.

FHA Loans - Annual Percentage Rate APR calculation assumes a 270019 loan 265375 base amount plus 4644 upfront mortgage insurance premium with a 35 down payment. By learning what lenders look at when deciding whether to make a loan youll be more confident in navigating the mortgage application process. Estimate how much you can borrow for your home loan using our borrowing power calculator.

The 5 Cs of Mortgage Lending. Reduces frictions in mortgage lending such as lengthy loan processing capacity constraints inefficient refinancing and limited access to finance by some borrowers. The principles of mortgage lending.

So in a series of blogs I am going to go over one of my first and core lessons on mortgage lending The 3 Cs which are. Communicate with brokers attorneys and borrowers to facilitate loan. 35 down on mortgages up to 2 million for second homes.

The 5 Cs of Mortgage Lending. Mortgage Loan Processor. In this paper we study the e ects of FinTech lending on the US.

Mortgage lending 30 focuses on using open banking to input data in real-time. Our main hypothesis is that the FinTech lending model represents a technological innovation that. View your borrowing capacity and estimated home loan repayments.

Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score. A formula for you to use to quickly determine if the property cash flows is. When youre ready to connect with a loan officer.

Annual Rental Income Vacancy Loss Payments Expenses Cash Flow.

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

The Future Of Ai In Mortgage Capacity

Bringing It Home Raising Home Ownership By Reforming Mortgage Finance Institute For Global Change

5 C S Of Credit To Get A Mortgage

Mortgage Capacity Assessment Mortgage Capacity Report

Free Mortgage How Much Can I Borrow Calculator

Mortgage Capacity Report

Apra S Mortgage Crackdown Catches Out Hopeful Home Buyers Abc News

Lending To Homebuyers Scottish Housing Market Review January March 2021 Gov Scot

Lending To Homebuyers Interest Rates Scottish Housing Market Review Q3 2021 Gov Scot

Mortgage Capacity Report

Lending To Homebuyers Scottish Housing Market Review January March 2021 Gov Scot

What Is Asset Based Lending Who Qualifies

Mortgage Capacity Assessment Mortgage Capacity Report

Bringing It Home Raising Home Ownership By Reforming Mortgage Finance Institute For Global Change

Capability Map With Focus On Loan Processing Capabilities 4 Th Level Download Scientific Diagram

Things To Consider Before Lending Money